Abstract The addition of RMB to the SDR currency basket means that the RMB is recognized and accepted by the international market. The RMB will exercise its currency function worldwide, gradually becoming a trade-denominated currency and settlement currency, financial transactions and investment currency, and an international reserve currency. 11...

The addition of RMB to the SDR currency basket means that the RMB is recognized and accepted by the international market. The RMB will exercise its currency function worldwide, gradually becoming a trade-denominated currency and settlement currency, financial transactions and investment currency, and an international reserve currency. On November 30th, the Executive Board of the International Monetary Fund (IMF) decided to include the RMB in the Special Drawing Rights (SDR) currency basket. This marks a new milestone in the internationalization of the renminbi.

The renminbi has joined the SDR currency basket, which is in full compliance with expectations. Undoubtedly, this will further enhance the international status of the renminbi and will also increase the voice of China's global trade rules. There are currently four SDR currency baskets, namely the US dollar, the euro, the British pound and the Japanese yen. As the first currency from developing countries, the renminbi “into the basket†is of great significance.

So the question is, why can the RMB join the SDR currency basket at this time?

First, from a macro perspective, this is because of the enhanced performance of China’s overall national strength. China is the second largest economy in the world, and its global influence plays an important role. From a development perspective, the Chinese economy and the world economy are gradually integrated. The international market is gradually increasing the demand for RMB for international trade settlement, financial product pricing and as a reserve currency.

After becoming the world's fifth-largest trading nation, China's importance in world trade and the global financial system is also growing. However, China's new round of opening up has accelerated the cross-border capital flow of RMB. The promotion of the “Belt and Road†strategy and the growth of “going out†demand will further increase the proportion of RMB settlement and drive large-scale cross-border investment financing and global scope. Asset allocation.

Second, from the perspective of the currency itself, this reflects the continuous improvement of the international status of the renminbi. The international status of the renminbi has increased, and it has performed exceptionally well in foreign exchange reserves, international bonds, foreign exchange trading in the foreign exchange market, and derivatives trading in the foreign exchange market. First, more and more countries are beginning to consider or have already used the renminbi as one of the international reserve currencies. The central bank has signed currency swap agreements with 31 countries or regions, with a total agreement amount of 3.1 trillion yuan.

Secondly, starting from the second quarter of 2013, the total amount of RMB outstanding international money market instruments has surpassed the total amount of unpaid international money market instruments, ranking fourth in the world. Third, the exchange rate of RMB in the international foreign exchange market is also growing rapidly. For example, in September this year, the average daily trading volume of RMB was 418 billion US dollars, up 18% from August.

Third, from the technical indicators, the renminbi has met the requirements of the added indicators. Previously, the most controversial criterion for the inclusion of the RMB in the SDR currency basket was that the currency was “freely usable†and could be widely used for payment of international transactions and widely traded in the major exchange rate markets. “Freely usable†includes both the widespread use of international economic transactions and the widespread use of international foreign market transactions.

In this regard, China has made efforts in the indicator of the widespread use of international economic transactions, including: First, to increase the proportion of the renminbi in official foreign exchange assets, currently ranked seventh in the world; second, the increase in international banking liabilities In 2014, RMB-denominated international bank deposits ranked 5th in the world; thirdly, the outstanding RMB international bonds increased rapidly, and the RMB-denominated international bonds ranked 8th in the world.

Then the question is coming again. What impact will it have on China after joining the SDR currency basket?

The addition of RMB to the SDR currency basket means that the RMB is recognized and accepted by the international market. The RMB will exercise its currency function worldwide, gradually becoming a trade-denominated currency and settlement currency, financial transactions and investment currency, and an international reserve currency.

Specifically, the renminbi's participation in the SDR currency basket will gradually affect the internationalization of the renminbi, the financial industry, especially the banking industry and financial consumers.

First, from the perspective of the impact on the internationalization of the RMB, the entry of the RMB into the SDR currency basket will help the renminbi to achieve breakthroughs in multilateral use, international investment and financing, cross-border asset allocation, and the international monetary system, which will help break through the renminbi. The dilemma of internationalization will further accelerate the internationalization of the RMB.

After joining the currency basket, the renminbi will play more responsibilities in the international monetary system and can spread the systemic risks that the transition depends on the dollar. The renminbi will play more responsibilities in the international monetary system, and its influence will also match its own economic strength. This will give the renminbi more positive factors, which in turn will promote the internationalization of the renminbi and help promote the current international economic and financial system. balance.

Of course, for China, the continuous internationalization of the RMB requires that China's financial infrastructure construction must be further strengthened. On October 8, the RMB cross-border payment system was officially launched, and a “highway†was established for the cross-border use of RMB, which conveniently connected the global RMB users.

Secondly, from the perspective of the impact on China's financial industry, the RMB joins the SDR currency basket, which not only meets the needs of the international market, but also promotes the reform of the IMF governance mechanism, and can promote domestic financial reforms, especially the reform of China's capital account opening and exchange rate formation mechanism. For China and the world economic and financial system, this will be a win-win result. The just-released “Thirteenth Five-Year Plan†proposal proposes to “expand the two-way opening of the financial industry†and orderly convert the RMB capital account convertible so that the RMB becomes a convertible and freely usable currency.

For the banking industry, the renminbi has joined the SDR currency basket, and the more frequent interaction between China's domestic market and the international market will make China's exchange rate and interest rate environment more complex and changeable, which means more challenges for commercial banks. The continuous opening of China's capital market also requires commercial banks to intensify the innovation of RMB-related products and services to meet the growing needs of domestic and foreign customers. How to find new development opportunities in the new environment, commercial banks need to carefully sort out.

Thirdly, from the perspective of the impact on financial consumers, with the relaxation of foreign exchange controls, the RMB settlement area has been expanding. The exchange and use of RMB in many countries and regions is quite common. Domestic residents do not need to travel abroad, visit relatives, study abroad, etc. For foreign exchange, they saved the handling fee for currency exchange and smoothed the settlement channel.

In the process of internationalization, with the expansion of the renminbi pricing function, such as the realization of international trade, energy, minerals, food and other commodities related to the lives of ordinary people, the renminbi valuation, not only can avoid the impact of exchange rate fluctuations on domestic inflation, but also reduce Due to the transaction costs brought about by foreign exchange settlement and purchase of foreign exchange, the cost of living for these goods is further reduced, and the effective purchasing power of ordinary people is enhanced to bring benefits to the people.

In addition, this will also help broaden the channels for domestic residents to invest overseas. Along with the acceleration of the internationalization of the RMB, the examination and approval system for domestic residents investing in overseas securities or other financial products is undergoing orderly reforms. In the future, domestic investors can not only allocate domestic stocks and domestic assets, but also arrange overseas assets more conveniently, and provide new channels for asset security and value preservation.

Of course, the addition of the RMB to the SDR currency basket is not entirely risk-free. The inclusion of SDR means that the process of liberalizing RMB capital projects will accelerate, and the central bank's liberalization of interventions on the RMB exchange rate will be reduced, which may affect domestic economic and financial stability. We can't take it lightly. (The author of this article: Executive Dean of the Hengfeng Bank Research Institute, Visiting Researcher of Chongyang Financial Research Institute of Renmin University of China, Sina Weibo: Returning from the East.)

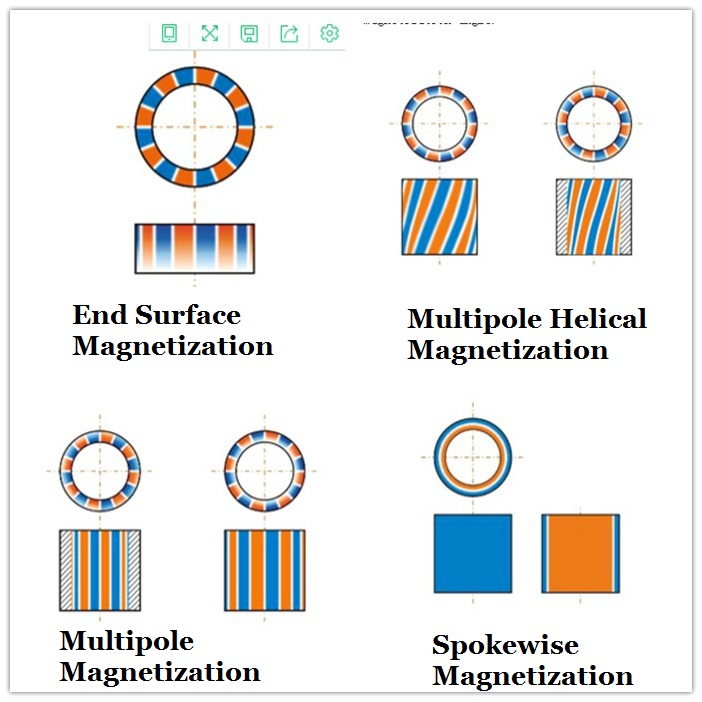

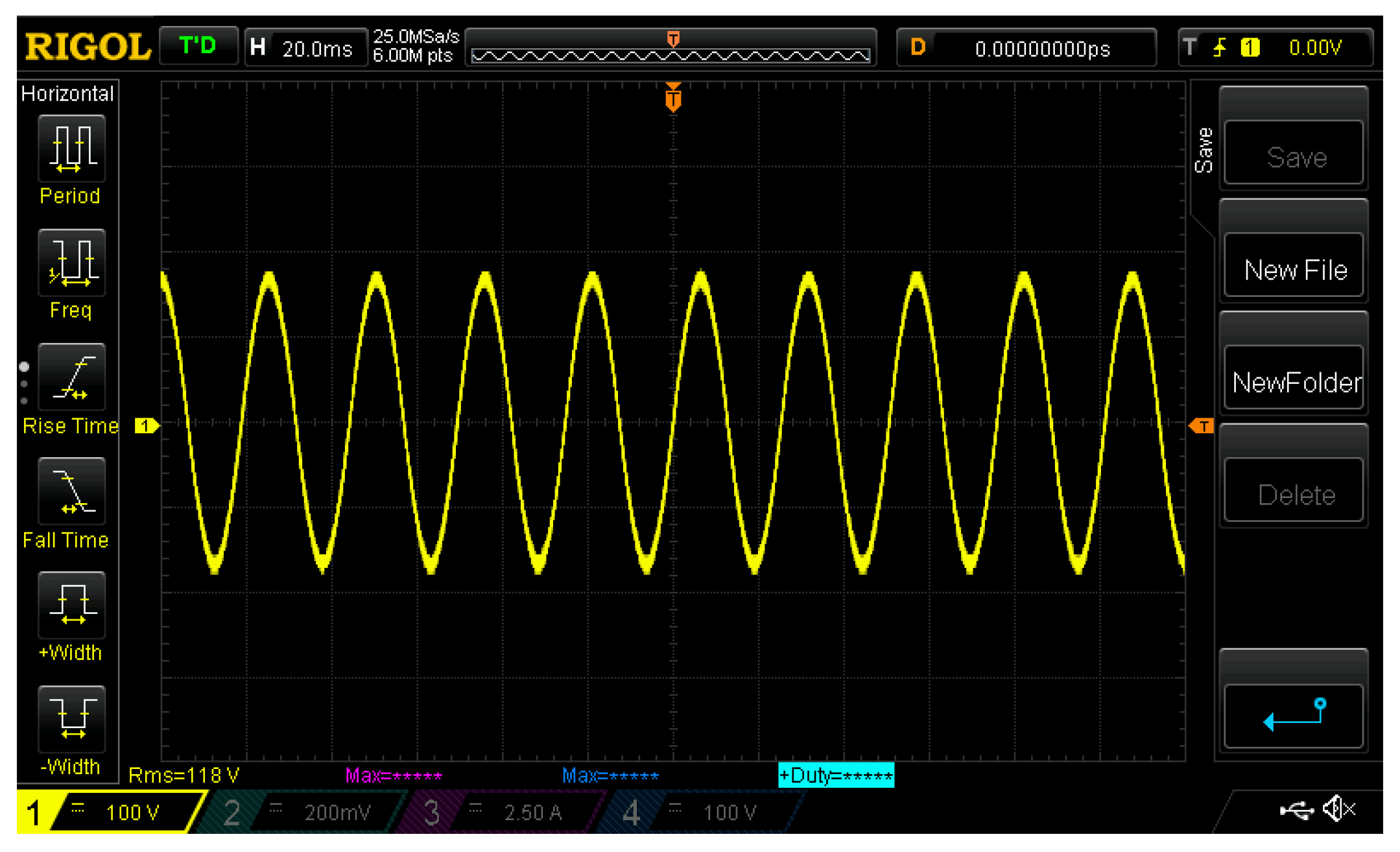

Multi-Poles Ferrite Magnet and Radiation magnetizing NdFeB Magnet can be easily assembly and with better magnet pole oscillogram.

Multi-Poles Magnet,Magnet Rotor for Pumps,4 Poles Magnet,Rotor for Draining Pumps

Chongqing Great Well Magnet Co.,ltd. , https://www.gwmagnet.com